3 top technologies changing banking and fintech Written on

TL;DR:

AI is transforming the landscape of banking and fintech. From the top technologies, face authentication is the one to choose to enhance security at login and transaction authentication processes.

Over the last few years, technology has revolutionized the banking industry. With the introduction of digital banking, online payments, and mobile applications, banking has become more accessible.

These technological advancements have not only changed the way we bank, but they have also transformed the way banks operate and interact with their customers. From the way we make transactions to the way we manage our finances, technology has brought significant changes to the banking industry.

In this era of digital transformation, technology has become an integral part of banking, and it continues to shape the future of the industry. In this context, it is worth exploring the various ways in which technology has changed the banking industry and its impact on both customers and banks.

Artificial intelligence (AI) and robotic process automation (RPA) are two emerging technologies that are rapidly transforming the landscape of banking and fintech. In this article, we'll explore these technologies and the impact they're having on the industry.

1. AI personalization

One of the most exciting applications of AI in the financial sector is personalization. By leveraging machine learning algorithms, banks and fintechs are able to provide highly tailored customer experiences. This can take the form of tailored investment recommendations or customized financial planning advice.

2. Repetitive task automation

RPA is another technology that is transforming the banking and fintech industry. RPA involves the use of software robots to automate repetitive tasks. This can include everything from data entry to account reconciliation.

3. Face authentication

Face authentication is another emerging technology that is gaining traction in the financial sector. This technology uses biometric data to verify a customer's identity. By comparing a customer's face to a pre-existing database, banks and fintechs can ensure that only authorized individuals have access to their accounts.

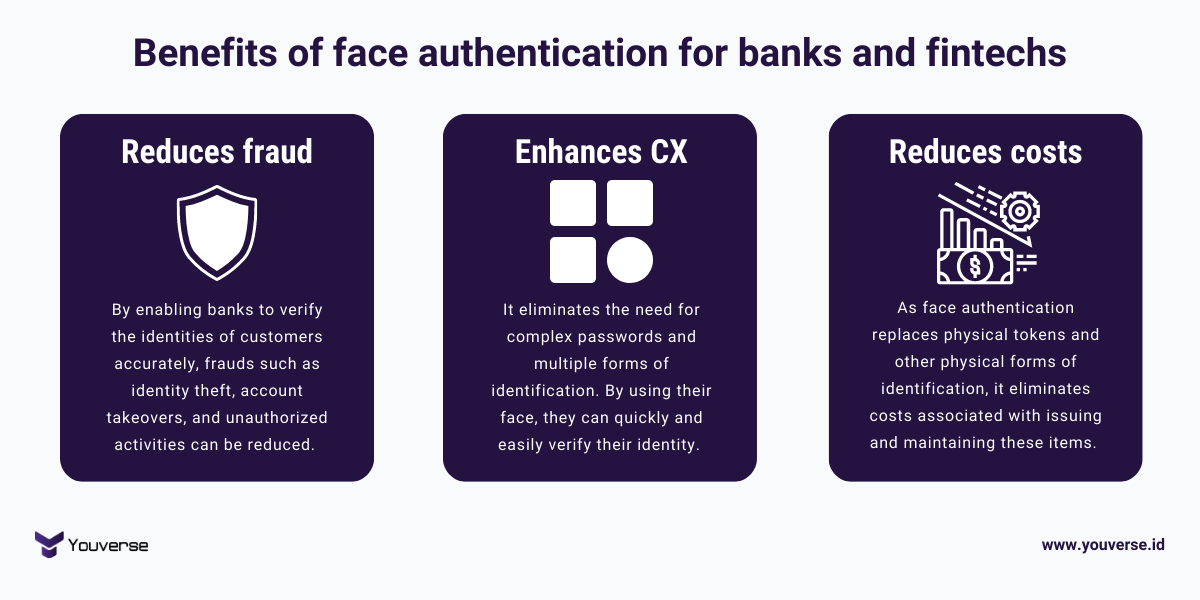

The benefits of using face as an authentication method

One of the main benefits of using face authentication in banks is increased security. It allows banks to verify the identity of customers with a high level of accuracy, reducing the risk of fraudulent activities such as identity theft, account takeovers, and unauthorized transactions.

Face authentication can also enhance the customer experience by offering a faster and more convenient way to authenticate transactions. Customers no longer need to remember complex passwords or carry multiple forms of identification with them. With face authentication, they can quickly and easily verify their identity using their face, providing a seamless and frictionless experience.

Finally, using face authentication can lead to cost savings for banks. By automating the authentication process, banks can reduce the need for manual verification, which can be time-consuming and costly. This can free staff to focus on other important tasks, improving efficiency and reducing costs. As face authentication replaces physical tokens and other physical forms of identification, it also eliminates costs associated with issuing and maintaining these items.

💡 Face biometrics make the authentication process in digital banking more secure and more convenient for customers.

Before you go

If you're curious about the challenges and benefits of implementing face authentication into your mobile banking app, download our ebook for free.